NEW DELHI, Dec 2: A day after the Lok Sabha cleared the Manipur Goods and Services Tax (Second Amendment) Bill, 2025, the Rajya Sabha on Tuesday returned the legislation to the Lower House, enabling the northeastern state currently under President’s Rule to move ahead with implementing the GST 2.0 reforms.

The Bill seeks to replace an Ordinance issued on October 7 to operationalise the revised GST structure in Manipur. The move comes as the state’s laws must be amended to align with decisions taken at the 56th GST Council meeting, which approved a major rationalisation of tax rates across nearly 375 items. The reforms merge the earlier 5%, 12%, 18% and 28% slabs into 2%, 5% and 18%, with a proposed 40% rate for ultra-luxury goods. These revised rates came into effect on September 22.

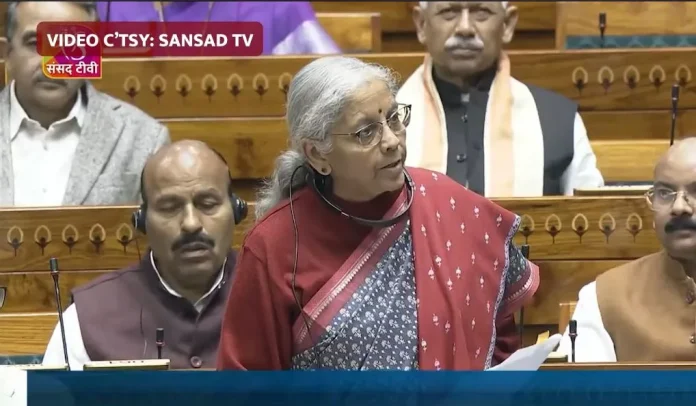

During the debate, Finance Minister Nirmala Sitharaman launched a strong attack on Opposition parties for staging a walkout over their demand for a discussion on the special intensive revision (SIR) of electoral rolls. Accusing them of “shedding crocodile tears on Manipur”, she said the Opposition had skipped both the state’s budget discussion earlier and Tuesday’s debate on a crucial Bill intended to extend GST benefits to Manipur.

“Even today, when GST benefits have to go to the state government, they are not here to participate. This is shameful… all the grievances they raise on Manipur are just drama,” Sitharaman said.

Her remarks came shortly after Opposition MPs walked out when the Chair refused to allow a debate on the SIR issue, sparking fresh protests that also led to adjournments earlier in the day.

The Bill was piloted in the Rajya Sabha by Minister of State for Finance Pankaj Chaudhary. After a brief discussion and Sitharaman’s intervention, the House passed the legislation by voice vote, formally returning it to the Lok Sabha for completion of the legislative process.