NEW DELHI, Feb 7: The Reserve Bank of India (RBI) today reduced the policy repo rate by 25 basis points for the first time in nearly five years. The Monetary Policy Committee (MPC) unanimously decided to lower the policy rate from 6.5% to 6.25%. As a result, the standing deposit facility (SDF) rate will be set at 6.0%, while the marginal standing facility (MSF) rate and the bank rate will remain at 6.5%. The MPC also decided to maintain a ‘neutral’ stance and focus on ensuring that inflation aligns with the target while supporting economic growth.

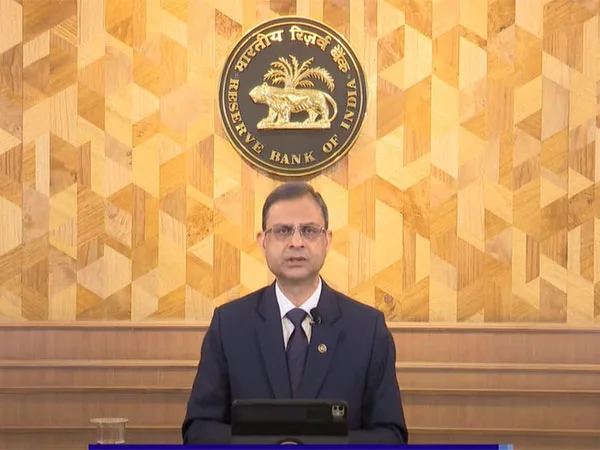

This move marks the first rate reduction since May 2020. The last change in the policy rate was in February 2023 when it was increased by 25 basis points to 6.5%. The decision comes at a time when global economic conditions remain challenging. RBI Governor Sanjay Malhotra acknowledged the difficult global landscape, where global growth continues to remain below historical averages despite signs of resilience in high-frequency indicators and expanding trade. He highlighted that global disinflation progress is stalling, hindered by inflation in services prices.

Malhotra also pointed out the strengthening of the US dollar due to market expectations surrounding the pace and size of rate cuts in the United States. He noted that this, along with hardened bond yields, large capital outflows from emerging markets, and sharp currency depreciations, has led to tighter financial conditions globally. These developments have exacerbated volatility in global financial markets, made worse by divergent monetary policies and ongoing geopolitical tensions.

Despite these challenges, Malhotra reassured that India’s economy remains strong and resilient, though not immune to external pressures. He noted that the Indian rupee has come under depreciation pressure, but emphasized that the RBI is actively deploying available tools to navigate the situation.

The MPC’s meeting, which began on February 5, 2025, will continue for three days, during which the committee will assess the economic conditions and adjust the interest rates accordingly. In the last MPC meeting in December 2024, the RBI cut the cash reserve ratio (CRR) by 50 basis points to 4%, while the policy rate was kept unchanged at 6.50%.