NEW DELHI, March 3: Women in India are playing a pivotal role in driving the nation’s financial growth, with an increasing number seeking credit and actively monitoring their credit scores, according to a new report launched by NITI Aayog. Titled “From Borrowers to Builders: Women’s Role in India’s Financial Growth Story”, the report reveals that 27 million women were actively monitoring their credit as of December 2024, marking a 42% increase from the previous year.

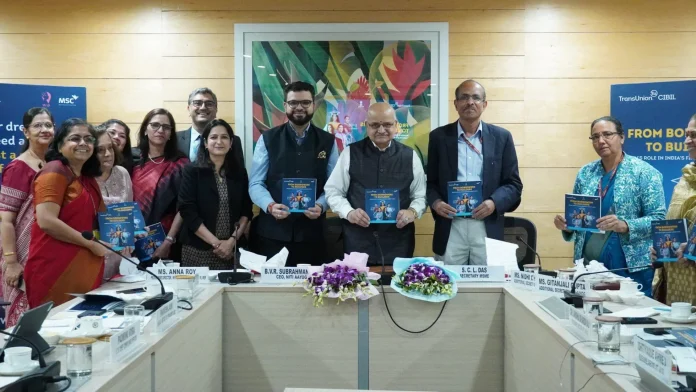

This report, which was launched in collaboration with TransUnion CIBIL, NITI Aayog’s Women Entrepreneurship Platform (WEP), and MicroSave Consulting (MSC), highlights the growing participation of women in the financial ecosystem. Women’s share in the total self-monitoring credit base rose to 19.43% in December 2024, up from 17.89% in 2023. Interestingly, women from non-metro regions exhibited a greater increase in self-monitoring, with a 48% rise, compared to a 30% increase in metro areas.

NITI Aayog CEO B.V.R. Subrahmanyam, while unveiling the report, emphasized that financial access is crucial to empowering women entrepreneurs. “Access to finance is a fundamental enabler for women’s entrepreneurship,” Subrahmanyam stated. He pointed out that the Women Entrepreneurship Platform (WEP) continues to build an inclusive ecosystem that fosters financial literacy, expands credit access, and strengthens mentorship and market linkages. He also urged financial institutions to design gender-smart products tailored to women’s unique needs, which could further accelerate this momentum.

The report also underscored a notable shift in borrowing patterns. Women’s share in business loan origination has grown by 14% since 2019, while their share in gold loans has increased by 6%. As of December 2024, women are expected to account for 35% of business borrowers. This reinforces women’s vital role in the country’s economic growth. However, the report also highlights barriers that still persist, such as credit aversion, poor banking experiences, lack of collateral, and difficulty in securing guarantors.

Adding to the growing concern of women’s participation in credit, the same report also discusses the leakage of exam papers that emerged as a concern for the Higher Secondary School Leaving Certificate Examination (HSSLCE) in Manipur. A separate issue that has raised alarm among students and authorities alike, the leak of the Physics question paper ahead of the exams was confirmed by the Students’ Union of Kangleikak, Manipur (SUK). The Union called for a thorough investigation to ensure strict action is taken against those responsible for the leak.

Despite this, the NITI Aayog report remains a beacon of progress, as it highlights the efforts needed to overcome financial barriers, and the rise in financial literacy among Indian women. It’s a strong reminder of the potential women have to contribute to India’s financial and economic growth. Anna Roy, Principal Economic Advisor at NITI Aayog, reinforced this vision by saying that promoting women’s entrepreneurship could create employment opportunities for up to 170 million people and drive greater workforce participation, all while achieving equitable economic growth for India.

While the education sector deals with issues of integrity, the financial sector shows positive signs of progress with growing female participation in business loans and credit monitoring. This indicates a broader shift toward a more inclusive and empowered future for women in India’s economy.